Cost basis per share calculator

To calculate the average cost divide the total purchase amount 2750 by the. CALCULATOR FOR STOCK SPINOFFS Press the CTRL key simultaneously with the F5 key to refresh the calculator and make sure you are using the latest version before you enter any data.

Cost Basis Calculator

To calculate the cost of multiple shares purchased simply add the individual cost basis for each share you own.

. Your cost basis is 1600. If you acquired your ATT shares prior to March 20 1998 the date of the last stock split or through a previous acquisition or merger transaction then first calculate your ATT. To do this divide the number of shares in the lot 60 by total.

Average Cost You take your total cost to purchase all of your shares which is 5300 and divide by 400. If you acquired your ATT Inc. Gains or losses are defined as short-term or long-term.

When buying price is different this calculator is needed to get the correct average cost per share. Use cost basis calculator. Average Cost per share Total purchases 2750 total number of shares owned 5661 4858.

When a sale is entered the capital gain or loss is calculated. This brings your cost basis to 1325 per. How Do You Calculate The Cost Basis Of Stock With Multiple Purchases.

The Cost Basis Calculator automatically calculates the cost basis and number of shares held for requested securities. About 2000 per share. Firstly you should know the number of.

By entering the number of shares units and share price cost per unit you can find the total. 60 shares costing 15 per share. Calculate the price weight of the first lot.

Using the average cost cost basis is calculated based on the average price paid for all shares held regardless of holding period. Just follow the 5 easy steps below. To calculate your profits for tax purposes youll need to subtract your cost basis for the five shares from the sale price of the five shares.

Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the. It covers complex factors like mergers spin. Shares prior to March 20 1998 date of last stock split or through a previous acquisition or merger transaction determining your cost basis is a TWO-STEP.

The Stock Calculator is very simple to use. Lot 2 40 shares costing 18 per share. How to use an average down calculator.

Computes the average cost base or cost per share for a series of stock or mutual fund purchases. Your adjusted cost basis for 100 new shares is now 20000 per share with the You still own the same percentage ownership of the business and no true economic. 150 x 5 - 100 x 5 250 The.

With this stock cost basis calculator you can determine the total cost basis of your investment.

How To Calculate Cost Base Per Share

Stock Average Calculator Cost Basis

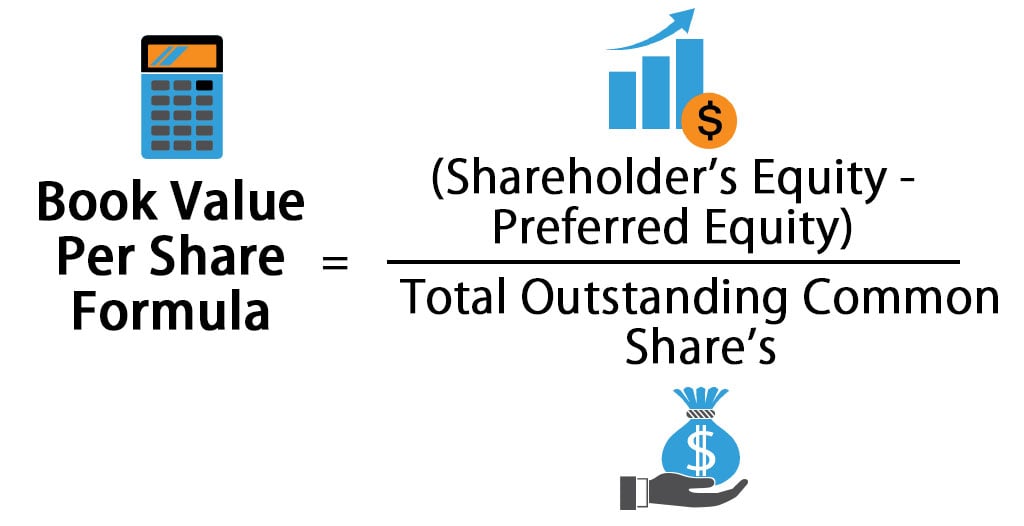

Book Value Per Share Formula Calculator Excel Template

Common Stock Formula Calculator Examples With Excel Template

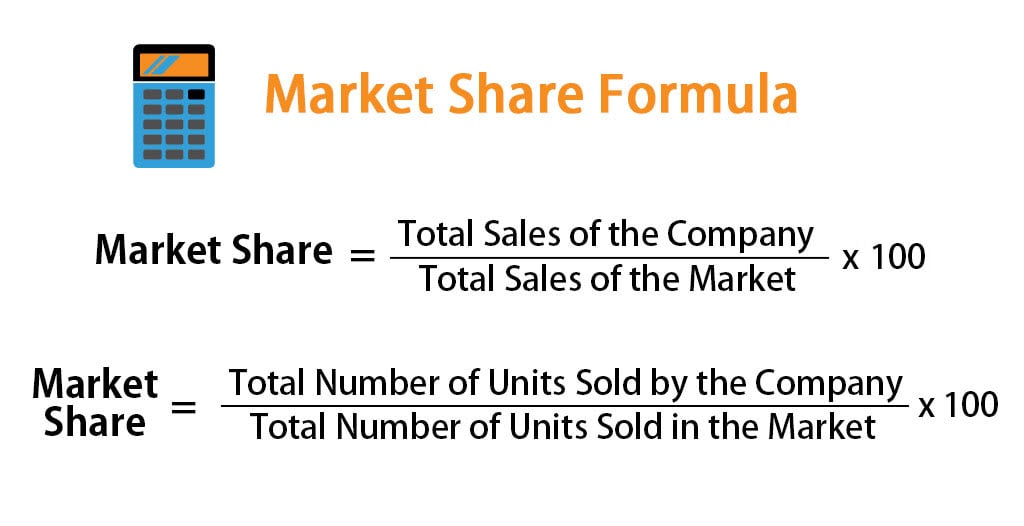

Market Share Formula Calculator Examples With Excel Template

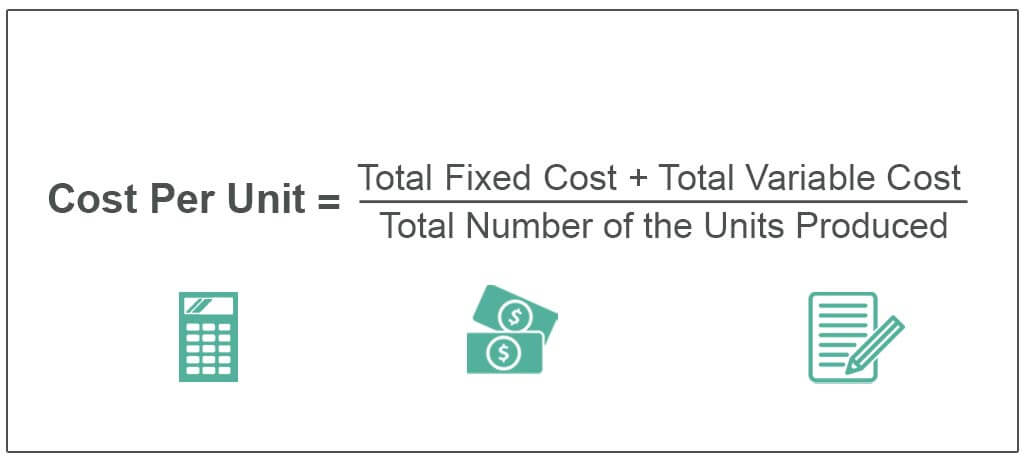

Cost Per Unit Definition Examples How To Calculate

Basic Earnings Per Share Eps Formula And Calculator Excel Template

Common Stock Formula Calculator Examples With Excel Template

Stock Average Calculator Cost Basis

Book Value Formula How To Calculate Book Value Of A Company

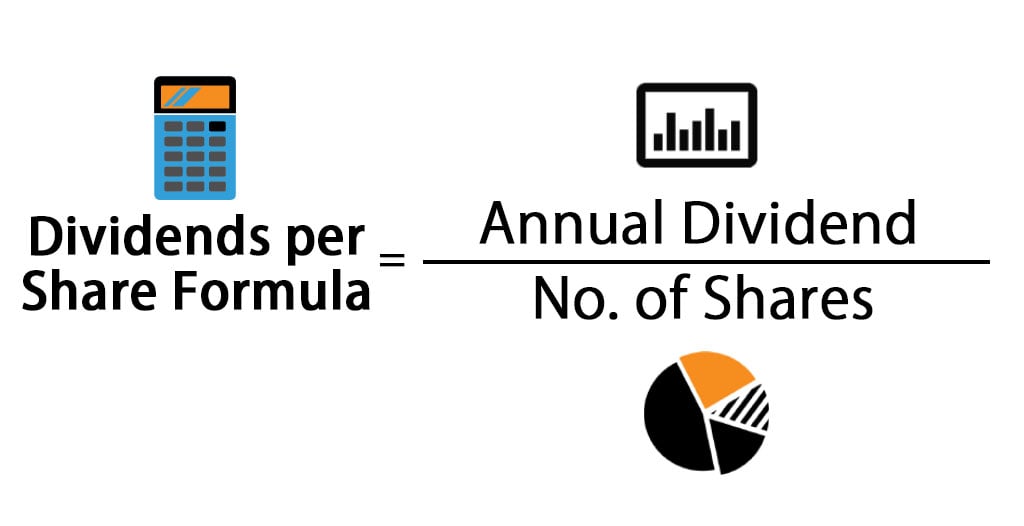

Dividends Per Share Formula Calculator Excel Template

How To Calculate Weighted Average Price Per Share Fox Business

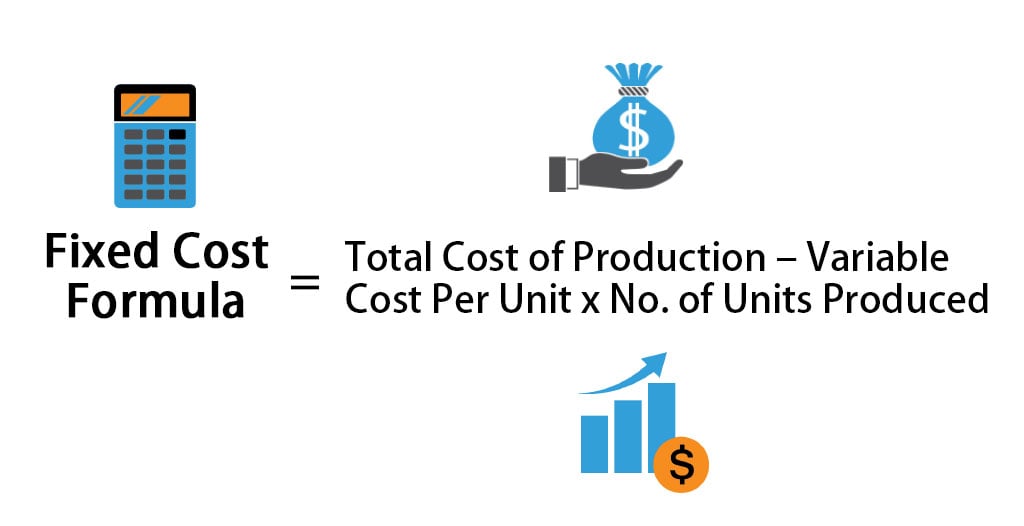

Fixed Cost Formula Calculator Examples With Excel Template

Basic Earnings Per Share Eps Formula And Calculator Excel Template

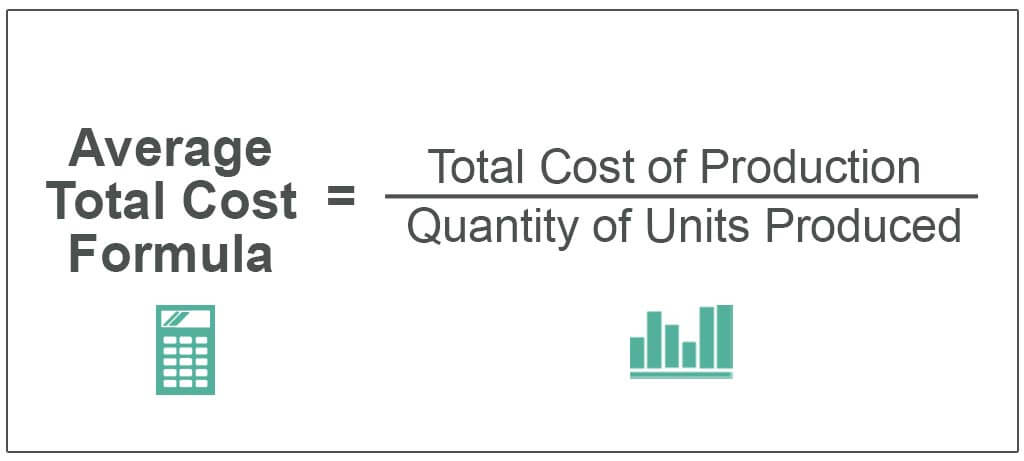

Average Total Cost Formula Step By Step Calculation

Future Value Of An Ordinary Annuity Mgt680 Lecture In Hindi Urdu 25

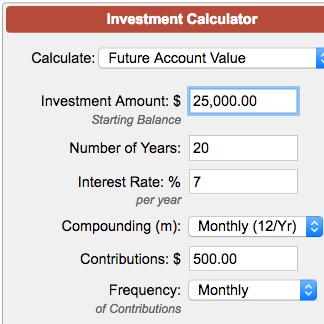

Investment Calculator